chap3 - CHAPTER 3 E3.1. Calculating a Price from Comparables P/E for the comparable firm = 100/5 = 20 P/B for the comparable firm = 100/50 = 2 Price for | Course Hero

chap3 - CHAPTER 3 E3.1. Calculating a Price from Comparables P/E for the comparable firm = 100/5 = 20 P/B for the comparable firm = 100/50 = 2 Price for | Course Hero

chap3 - CHAPTER 3 E3.1. Calculating a Price from Comparables P/E for the comparable firm = 100/5 = 20 P/B for the comparable firm = 100/50 = 2 Price for | Course Hero

chap3 - CHAPTER 3 E3.1. Calculating a Price from Comparables P/E for the comparable firm = 100/5 = 20 P/B for the comparable firm = 100/50 = 2 Price for | Course Hero

chap3 - CHAPTER 3 E3.1. Calculating a Price from Comparables P/E for the comparable firm = 100/5 = 20 P/B for the comparable firm = 100/50 = 2 Price for | Course Hero

chap3 - CHAPTER 3 E3.1. Calculating a Price from Comparables P/E for the comparable firm = 100/5 = 20 P/B for the comparable firm = 100/50 = 2 Price for | Course Hero

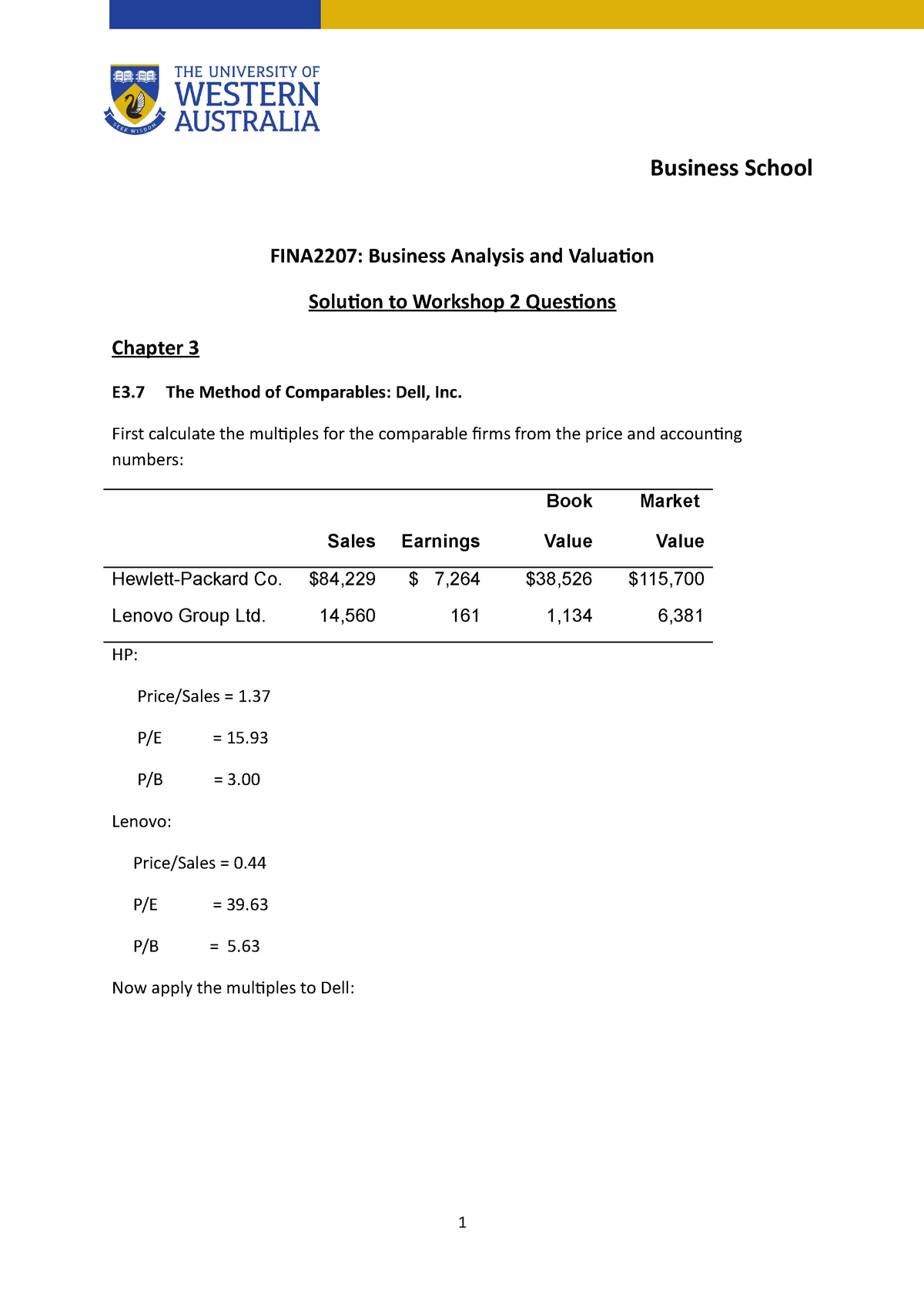

Workshop 2 - Business School FINA2207: Business Analysis and Valuation Solution to Workshop 2 - Studocu

Chapter_3&4_Tutorial.pptx - E 3.1: Calculating a Price from Comparables A firm trading with a total equity market value of $100 million reported | Course Hero

chap3 - CHAPTER 3 E3.1. Calculating a Price from Comparables P/E for the comparable firm = 100/5 = 20 P/B for the comparable firm = 100/50 = 2 Price for | Course Hero

chap3 - CHAPTER 3 E3.1. Calculating a Price from Comparables P/E for the comparable firm = 100/5 = 20 P/B for the comparable firm = 100/50 = 2 Price for | Course Hero

Chapter_3&4_Tutorial.pptx - E 3.1: Calculating a Price from Comparables A firm trading with a total equity market value of $100 million reported | Course Hero

chap3 - CHAPTER 3 E3.1. Calculating a Price from Comparables P/E for the comparable firm = 100/5 = 20 P/B for the comparable firm = 100/50 = 2 Price for | Course Hero

Chapter_3&4_Tutorial.pptx - E 3.1: Calculating a Price from Comparables A firm trading with a total equity market value of $100 million reported | Course Hero

Chapter_3&4_Tutorial.pptx - E 3.1: Calculating a Price from Comparables A firm trading with a total equity market value of $100 million reported | Course Hero