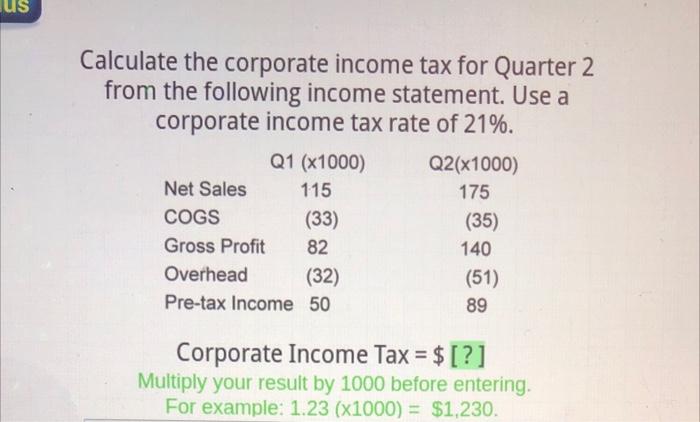

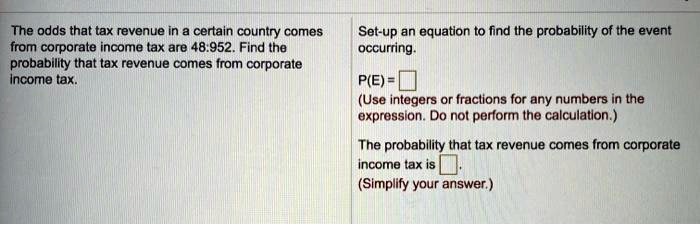

SOLVED: The odds that tax revenue in a certain country comes from corporate income tax are 48.952. Find the probabillty that tax revenue comes from corporate Income tax: Set-up an equation to

1 Speaker Name: André Marius Le Prince Company:WLP GmbH, Hamburg, Germany WIRA AG, Munich, Stuttgart, Düsseldorf, Nurnberg, Hamburg, Germany Phone: ppt download